0 INR

0 INR

Aaj ke time par business ko start karne ya grow karne ke liye funds ki zarurat hoti hai. Lekin har kisi ke paas itne funds ready nahi hote. Is situation mein business loan ek perfect solution hota hai. Lekin business loan kya hota hai aur ye kaise kaam karta hai, ye samajhna zaroori hai. Agar aapko apne business ke liye loan lena hai, toh is article mein hum aapko puri jankari denge taaki aap informed decision le saken.

Business Loan Kya Hota Hai?

Business loan kya hota hai, iska simple matlab hai ki yeh ek loan hai jo kisi bhi business ke liye diya jata hai. Ye loan kisi naye business ko shuru karne, existing business ko expand karne, ya working capital ko maintain karne ke liye diya jata hai.

- Purpose: Business loan ka main objective hota hai ki business ke financial needs ko pura karna.

- Lenders: Ye loan banks, NBFCs (Non-Banking Financial Companies), aur online lending platforms ke through diya jata hai.

- Repayment: Loan ko fixed EMI (Equated Monthly Installments) ke through repay kiya jata hai.

Types of Business Loans

Business loan kaafi types ke hote hain jo alag-alag business needs ke liye suitable hote hain:

1. Term Loan

- Kya hai: Term loan ek fixed tenure ke liye diya jata hai, jaise 1 se 5 saal tak.

- Purpose: Business ko expand karne ya nayi machinery kharidne ke liye.

2. Working Capital Loan

- Kya hai: Yeh loan day-to-day operations ke liye diya jata hai.

- Purpose: Inventory purchase, employee salary ya short-term operational costs ke liye.

3. Line of Credit

- Kya hai: Line of credit ek flexible loan option hota hai jahan aapko approved limit tak paisa milta hai.

- Purpose: Cash flow manage karne ke liye.

4. Machinery Loan

- Kya hai: Is loan ka use nayi machinery ya equipment purchase karne ke liye hota hai.

- Purpose: Manufacturing ya production business ke liye important hai.

Business Loan Kaise Milta Hai?

Agar aapko business loan lena hai, toh aapko kuch steps follow karne honge. Niche humne bataya hai ki aap kaise loan apply kar sakte hain:

- Eligibility Criteria Check Karein:

- Business ka age minimum 1-2 years hona chahiye.

- Applicant ki age 21 se 65 saal ke beech honi chahiye.

- Minimum turnover aur profit margin hona zaroori hai.

- Documents Ready Karein:

Business loan lene ke liye aapko yeh documents chahiye hote hain:- Business registration proof

- KYC documents (Aadhaar, PAN Card, Address Proof)

- Bank statements (last 6-12 mahine ke)

- ITR (Income Tax Return) reports

- Lender Choose Karein:

Banks, NBFCs ya online lenders ke offers ko compare karein. Interest rates, loan tenure aur processing fees ka dhyan rakhein. - Loan Application Submit Karein:

Properly filled application form ke saath documents submit karein. Lenders loan approve karne ke baad fund disburse karte hain.

Recommend Read: Business Loan Kaise Milta Hai

Business Loan Ke Benefits

Business loan kya hota hai ye samajhne ke saath saath, iska fayda bhi samajhna important hai:

- Flexible Repayment: EMI ke through loan ko easy installments mein repay kar sakte hain.

- No Collateral (Unsecured Loan): Kuch lenders business loans collateral-free bhi dete hain.

- Quick Disbursal: Online platforms ke zariye business loans ka approval aur disbursal kaafi fast hota hai.

- Improves Cash Flow: Business loans cash flow manage karne aur business ko grow karne mein madadgar hote hain.

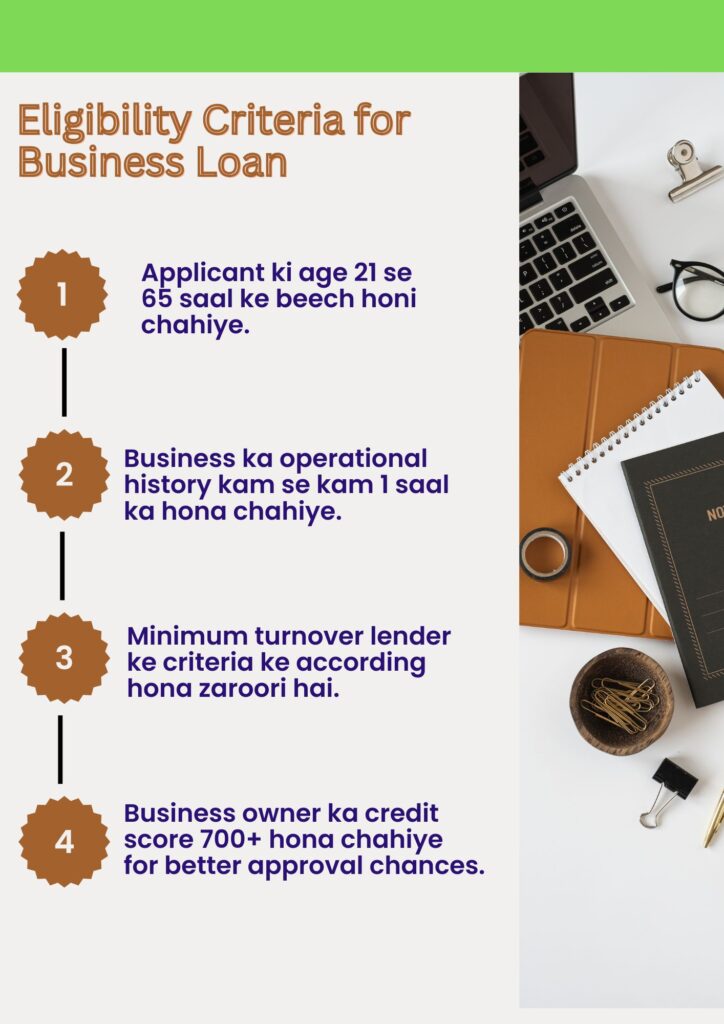

Eligibility Criteria for Business Loan

Aapko business loan apply karne se pehle yeh criteria fulfill karne honge:

1. Business owner ka credit score 700+ hona chahiye for better approval chances.

2. Applicant ki age 21 se 65 saal ke beech honi chahiye.

3. Business ka operational history kam se kam 1 saal ka hona chahiye.

4. Minimum turnover lender ke criteria ke according hona zaroori hai.

Jaarur Pdhna: Eligible for a Business Loan

Interest Rates aur Repayment Options

Interest rates lenders ke upar depend karte hain. Bank, NBFCs aur online lenders ke rates different hote hain.

| Lender Type | Interest Rate Range |

|---|---|

| Banks | 8% – 15% |

| NBFCs | 12% – 20% |

| Online Lenders | 15% – 24% |

Repayment Options:

Loan ka repayment monthly EMIs ke through hota hai. Kuch lenders prepayment options bhi offer karte hain.

Business Loan Lene Mein Galtiyan Avoid Karein

Aksar log business loan lete time kuch common galtiyan karte hain jo avoid karni chahiye:

- Eligibility Criteria na Check Karna.

- Documents ka Improper Submission.

- Multiple Lenders se Ek Saath Apply Karna.

- Hidden Costs ko Ignore Karna.

- Loan ka Purpose Clearly Define Na Karna.

Recommend Read: Business Loan Nahi Bhara To Kya Hoga

CredNow ke Saath Business Loan Kaise Lein?

Agar aapko hassle-free aur transparent business loan lena hai, toh CredNow aapke liye perfect platform hai. CredNow fast approval, flexible repayment options aur transparent terms ke saath businesses ko fund provide karta hai. Online application ke through aap asani se apna loan apply kar sakte hain aur apne business ko next level par le ja sakte hain.

Conclusion

Ab aapko samajh aa gaya hoga ki business loan kya hota hai aur kaise yeh aapke business ki growth mein madad kar sakta hai. Business loan lena ek important financial decision hai, isliye loan lene se pehle eligibility, interest rates, aur repayment options ko dhyan se samajhna chahiye. CredNow jaise platforms ke through aapka loan process simple aur hassle-free ho sakta hai.

FAQs

1. Business loan kya hota hai aur kyon zaroori hai?

Business loan ek financial help hai jo kisi business ko grow karne, shuru karne ya operations ke liye diya jata hai.

2. Business loan lene ke liye credit score kitna hona chahiye?

Credit score 700+ hona preferable hota hai for quick approval.

3. Kya business loan collateral-free hota hai?

Haan, kuch lenders unsecured business loans bhi provide karte hain jo collateral-free hote hain.

4. Business loan apply karne ke liye kaunse documents chahiye?

Aapko KYC, bank statements, ITR, aur business registration proof submit karna hota hai.

5. CredNow se business loan kaise apply karein?

CredNow ki website visit karein, form fill karein aur documents submit karen. Approval ke baad funds jaldi disburse kiye jaate hain.