Personal loans ka concept aaj kal kaafi common ho gaya hai, lekin bohot log abhi bhi inke baare mein puri tarah se aware nahi hai. Agar aap bhi personal loan lene ka soch rahe hain, to is blog ko zaroor padhiye. Yahaan hum baat karenge personal loans kya hote hain, kaise kaam karte hain, inke kya benefits aur features hote hain, aur inhe kis liye use kiya jaa sakta hai. Is blog ke end tak aapko personal loans ke baare mein sab kuch pata chal jayega jo aapko loan lene se pehle zaroor jaana chahiye.

Personal Loans kya hai

Personal loans, jaise naam se hi pata chal raha hai, personal use ke liye diye jaane wale loans hote hain. Yeh ek type ka unsecured loan hai, jiska matlab hai ki aapko collateral ya security dene ki zaroorat nahi hoti. Bank aur financial institutions aapko aapki creditworthiness ke basis par loan dete hain. Yani agar aapki credit history achi hai aur aapki income stable hai, to aapko personal loan milne ki probability zyada hoti hai.

Personal Loans kaise kaam karte hai

Personal loans ko lena aur repay karna dono kaafi simple process hai. Chaliye step by step samajhte hain:

1. Application Process: Pehle aapko loan ke liye apply karna padta hai. Aap ye kaam bank ki branch mein jaake ya online bhi kar sakte hain. Aapko apne personal aur financial details dene padte hain, jaise ki income proof, identity proof, address proof, etc.

2. Approval: Bank aapke documents verify karta hai aur aapki creditworthiness check karta hai. Agar sab kuch theek hota hai to loan approve ho jata hai.

3. Disbursement: Loan approve hone ke baad amount aapke account mein transfer kar diya jata hai. Yeh process usually kuch dinon mein complete ho jata hai.

4. Repayment: Aapko loan amount ko EMIs (Equated Monthly Installments) mein repay karna hota hai. EMI amount aur tenure aapki financial capability ke hisaab se decide hota hai. Aapko har mahine ek fixed amount bank ko repay karna hota hai jab tak aapka loan poora repay na ho jaye.

Personal Loans lene ke faide

Personal loans lene ke kaafi saare benefits aur features hote hain jo ise baaki loans se different aur attractive banate hain. Chaliye inhe detail mein samajhte hain:

1. No Collateral Required: Jaise ki pehle bataya, personal loans ke liye aapko koi collateral ya security dene ki zaroorat nahi hoti. Yeh ek unsecured loan hota hai jo sirf aapki creditworthiness par diya jata hai.

2. Flexible End Use: Aap personal loan ka use kisi bhi purpose ke liye kar sakte hain, chahe woh ghar ka renovation ho, shaadi ka kharcha ho, medical emergency ho ya phir travel ka plan ho. Aapko bank ko batane ki zaroorat nahi hoti ki aap loan ka use kis liye kar rahe hain.

3. Quick Disbursement: Personal loans ka disbursement process kaafi fast hota hai. Agar aapka credit score achha hai aur documents theek hain to aapko loan amount kuch dinon mein hi mil jata hai.

4. Fixed Interest Rate: Zyada tar personal loans fixed interest rate par diye jaate hain. Yani aapko har mahine ek fixed EMI pay karni hoti hai, jo aapke budget planning mein help karta hai.

5. Flexible Tenure: Personal loans ki repayment tenure kaafi flexible hoti hai. Aap apni repayment capacity ke hisaab se tenure choose kar sakte hain, jo usually 12 mahine se leke 60 mahine tak hoti hai.

6. Minimal Documentation: Personal loans lene ke liye aapko zyada documents submit karne ki zaroorat nahi hoti. Basic KYC documents aur income proof hi required hota hai.

Personal Loans kis kaam aata hai:

Personal loans ka use aap apni zarurat ke hisaab se kisi bhi purpose ke liye kar sakte hain. Kuch common uses yeh hain:

1. Debt Consolidation: Agar aapke upar multiple debts hain, to aap personal loan leke unhe consolidate kar sakte hain. Isse aapko multiple EMIs ke bajaye sirf ek EMI pay karni padti hai.

2. Home Renovation: Ghar ka renovation karwana ho ya koi repair work karwana ho, aap personal loan ka use is purpose ke liye kar sakte hain.

3. Medical Emergencies: Medical emergencies kabhi bhi aa sakti hain. Aise mein personal loan aapko financial support provide karta hai.

4. Wedding Expenses: Shaadi ke expenses kaafi high hote hain. Agar aapke paas required funds nahi hain, to aap personal loan leke shaadi ke kharche manage kar sakte hain.

5. Education: Higher education ke liye bhi aap personal loan le sakte hain. Yeh aapki aur aapke family ki financial burden ko reduce karta hai.

6. Travel: Agar aapka dream vacation ka plan hai, to aap personal loan leke apne sapne ko poora kar sakte hain.

Final Thoughts

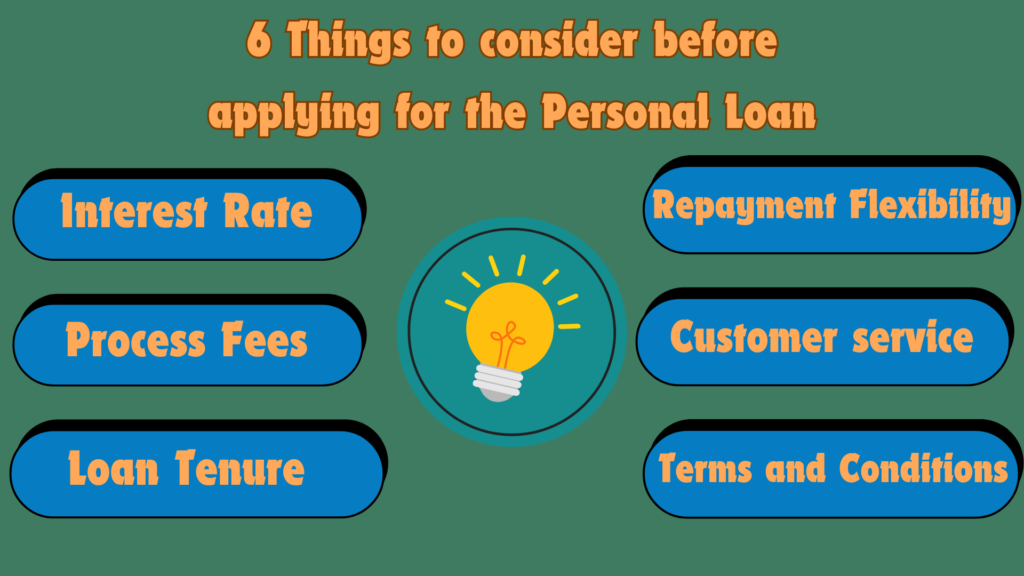

Personal loans lene se pehle kuch essential cheezon ko dhyan mein rakhna zaroori hai. Sabse pehle apna credit score check karein aur ensure karein ki aapki creditworthiness achi ho. Secondly, apni repayment capacity ko assess karein aur uske hisaab se loan amount aur tenure choose karein. Aur lastly, different lenders ke offers compare karein aur best interest rate aur terms select karein. Personal loans financial emergencies mein kaafi helpful hote hain, lekin responsible borrowing aur timely repayment ko hamesha priority deni chahiye. Or blogs read krnae kae lea financebabu p jaayea

FAQs–Personal Loans kaise kaam karte hai

Q1. Personal loan lene ke liye minimum credit score kitna hona chahiye?

A1. Usually, personal loan ke liye minimum credit score 650 hona chahiye. Lekin higher credit score se aapko better interest rate aur terms mil sakte hain.

Q2. Kya personal loan lene ke baad prepayment kar sakte hain?

A2. Haan, aap personal loan ka prepayment kar sakte hain. Lekin kuch banks prepayment penalty charge kar sakte hain, to is baare mein pehle hi confirm kar lein.

Q3. Personal loan lene ke baad kaise track karein ki kitna amount repay karna baki hai?

A3. Aap apne bank se statement le sakte hain ya phir online banking aur mobile banking ke through apna loan balance check kar sakte hain.

Q4. Kya personal loan ke interest rates fixed hote hain ya variable?

A4. Zyada tar personal loans fixed interest rate par diye jaate hain. Lekin kuch lenders variable interest rate bhi offer karte hain, to aap apne hisaab se choose kar sakte hain.

Q5. Personal loan ka tenure kitna hota hai?

A5. Personal loan ka tenure usually 12 mahine se leke 60 mahine tak hota hai. Aap apni repayment capacity ke hisaab se tenure choose kar sakte hain.