Jab baat aati hai financial planning aur urgent fund requirements ki, personal loan ek flexible aur accessible option ho sakta hai. Lekin sabse pehle, aapko samajhna hoga ki personal loan kitna mil sakta hai aur ismein kya factors influence karte hain. Is blog mein hum detail mein explore karenge personal loan ke baare mein aur ye bhi dekhenge ki aapko kitna loan mil sakta hai.

Introduction

Personal loan, jaise ki naam se pata chalta hai, ek loan hai jo aap apni personal financial needs ko pura karne ke liye lete hain. Yeh loan usually unsecured hota hai, matlab bina kisi collateral ke bhi mil sakta hai.

Personal Loan Kya Hai?

Personal loan ek tarah ka unsecured loan hota hai jo banks, NBFCs aur financial institutions provide karte hain. Is loan ko aap apni zarurat ke mutabik istemal kar sakte hain jaise ki shaadi, safar, education expenses ya phir medical emergencies ke liye.

Personal Loan Kyun Zaruri Hai?

Log personal loan various reasons se lete hain, jaise ki:

– Shaadi: Shaadi ke kharche ke liye.

– Safar: Ghumne ya business ke liye.

– Education: Higher studies ke liye.

– Medical Emergencies:Achanak ki aane wali medical expenses ke liye.

Personal Loan Ki Eligibility Kya Hai?

Personal loan lene ke liye kuch basic eligibility criteria hote hain jo usually banks aur financial institutions set karte hain:

– Aapki minimum age 21 years honi chahiye aur maximum 60 years tak.

– Aapko regular source of income hona chahiye.

– Aapka credit score 750 ya usse upar hona chahiye.

Recommended read: Personal Loan Apply Karne Se Pehle Yeh Zaroor Jaanein

Loan Amount Ko Influence Karne Wale Factors

Aapki personal loan amount ko decide karne mein kuch key factors hote hain:

– Income: Aapki monthly income jaise jyada hogi, utni zyada loan amount mil sakti hai.

– Credit Score: Aapka credit score jitna achha hoga, utni zyada chances hote hain ki aapko zyada loan amount milega.

– Debt-to-Income Ratio: Aapka current debt aur income ka ratio bhi loan amount ko influence karta hai.

Bank aur NBFC Se Milne Wali Loan Amount

Banks aur Non-Banking Financial Companies (NBFCs) personal loan provide karte hain, lekin unki policies aur terms alag-alag ho sakti hain:

– Banks: Banks usually aapki income aur credit score ke basis par loan amount decide karte hain.

– NBFCs: NBFCs zyada flexible hote hain aur low credit score wale applicants ko bhi loan provide kar sakte hain.

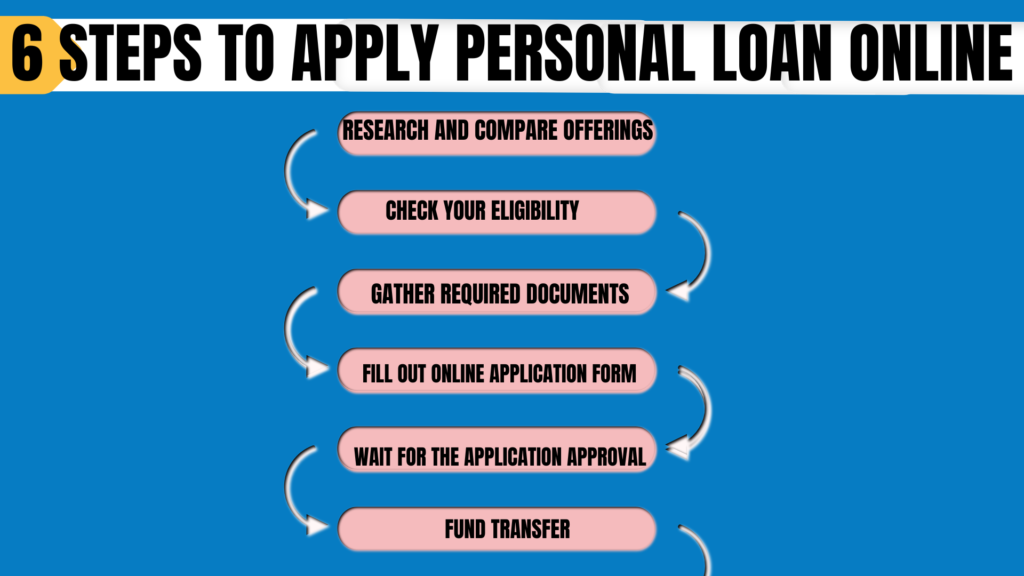

Personal Loan Lene Ki Process

Personal loan lene ki process usually kuch steps follow karti hai:

– Application form fill karna.

– Required documents submit karna jaise ki identity proof, income proof aur address proof.

– Loan approval aur amount ka disbursal.

Loan Lene Ke Fayde aur Nuksan

Fayde:

–Quick Disbursal: Personal loan ki ek badi fayda hai ki iska approval process usually bahut fast hota hai. Agar aapki documents sahi hain aur eligibility criteria mein fit hain, toh aapko loan jaldi mil sakta hai. Isse aap urgent financial needs ko jaldi pura kar sakte hain jaise ki medical emergency ya unexpected expenses.

–No Collateral Required: Personal loan unsecured hota hai, matlab aapko kisi bhi collateral ya security deposit ki zarurat nahi hoti. Iska matlab hai ki aap loan lene ke liye apne assets ko risk mein nahi daal rahe hain.

–Flexible Repayment Options: Aapko usually personal loan ke liye flexible repayment options milte hain. Aap apni financial capability ke according loan ki EMI aur tenure choose kar sakte hain, jo aapko comfortable ho.

-Multi-Purpose Use: Personal loan ka use aap apni zarurat ke mutabik kar sakte hain. Chahe shaadi ka kharcha ho, ghar ka renovation ho ya phir vacation plan ho, aap personal loan se kisi bhi purpose ke liye funds arrange kar sakte hain.

Nuksan:

-High Interest Rates: Personal loan usually unsecured hota hai, isliye interest rates thoda higher ho sakte hain compared to secured loans jaise home loan ya car loan. Aapko interest rates pe dhyan dena zaroori hai, kyunki agar aap timely payments nahi kar sakte toh interest charges aapke liye costly ho sakte hain.

–Impact on Credit Score: Agar aap loan ki payments ko time par nahi karte hain ya phir default karte hain, toh aapka credit score affect ho sakta hai. Lower credit score aapki future financial transactions aur loans ke liye bhi problem create kar sakta hai.

-Debt Accumulation: Agar aap bina planning ke aur bina zarurat ke loans lete hain, toh aap debt trap mein bhi fas sakte hain. Zyaada loans lene se aapki financial stability pe bhi negative impact ho sakta hai.

-Penalties and Fees: Loan agreements mein hidden charges, penalties aur fees ho sakte hain. Aapko loan lene se pehle in sabko bhi samajhna zaroori hai, taaki aap future mein koi unexpected financial burden na uthana pade.

Personal Loan Ke Liye Zaruri Documents

Loan application ke time par aapko kuch essential documents submit karne hote hain:

– Identity proof (Aadhaar Card, PAN Card).

– Income proof (Salary slips, ITR).

– Address proof (Electricity bill, Ration Card).

Personal Loan Lene Ke Tips

Tips:

– Loan lene se pehle apne financial needs ko clear karein.

– Different banks aur NBFCs ke offers aur terms ko compare karein.

– Loan amount sirf utna hi lein jitna zarurat ho.

Conclusion

Personal loan ek beneficial financial tool hai jo aapke immediate financial requirements ko meet karne mein madad karta hai. Lekin, loan lene se pehle aapko apni financial situation ko analyze karna aur repayment capability ko consider karna zaroori hai.

Frequently Asked Questions (FAQs)

1. Personal Loan Kitna Mil Sakta Hai?

Aapki income, credit score aur existing debts ke basis par, aapko personal loan ki amount 50,000 rupaye se lekar 25 lakh rupaye tak mil sakti hai.

2. Personal Loan Ki Interest Rates Kya Hoti Hain?

Interest rates usually 10% se lekar 24% tak ho sakti hain, jo aapke credit score aur lender ki policies par depend karta hai.

3. Personal Loan Ki Tenure Kitni Hoti Hai?

Personal loan ki repayment tenure generally 12 months se lekar 60 months tak ho sakti hai, depending on the lender.

4. Kya Bina Job Ke Personal Loan Mil Sakta Hai?

Bina job ke personal loan milna mushkil ho sakta hai, lekin agar aapke paas alternate income sources hain toh kuch lenders aapko loan provide kar sakte hain.

5. Personal Loan Lene Se Pehle Kya Dhyan Rakhna Chahiye?

Loan lene se pehle apni financial capacity ko evaluate karein, interest rates aur loan terms ko samjhein, aur sure ho jayein ki aap timely repayments kar sakte hain.