SBI Mudra Loan kya hai aur yeh aapke liye kaise faydemand ho sakta hai? Agar aap ek naye business ko shuru karne ka soch rahe hain ya apne chalte business ko badhane ka irada rakhte hain, toh SBI Mudra Loan ek bahut hi accha option ho sakta hai. Is article mein hum detail mein samjhenge ki yeh loan kaise kaam karta hai, iska process kya hai aur kaun-kaun isse le sakte hain.

Introduction to SBI Mudra Loan

SBI Mudra Loan ek aisa financial product hai jo ki Micro Units Development and Refinance Agency (MUDRA) ke under aata hai. Yeh loan un logon ke liye hai jo apna chhota business shuru karna chahte hain ya apne existing business ko expand karna chahte hain. Mudra Loan ka maksat hai ki un entrepreneurs ko support karna jinka scale of operations bahut chhota hai, lekin unhe paiso ki zaroorat hai.

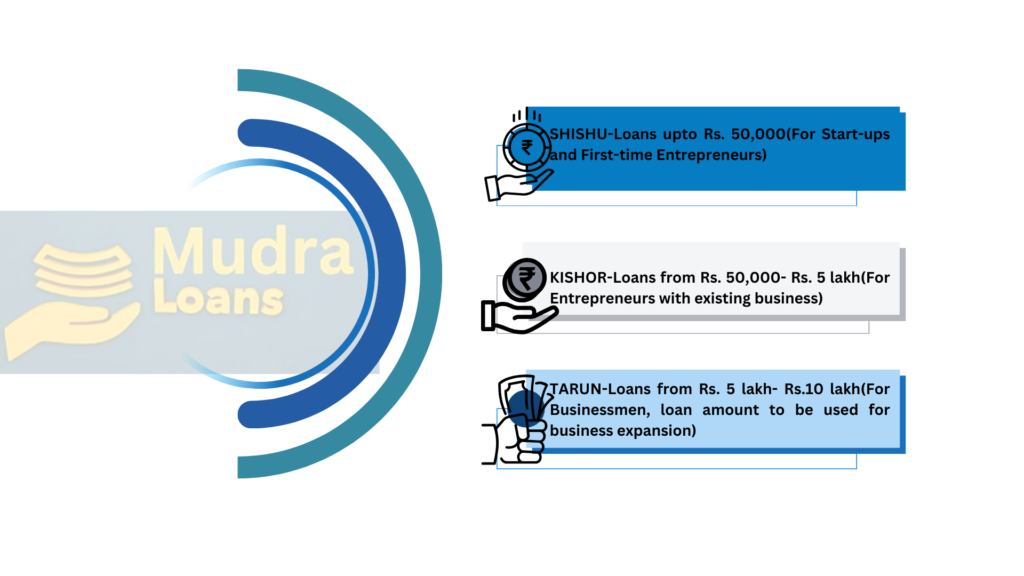

Types of Mudra Loans

Mudra Loans teen categories mein aate hain:

- Shishu Loan: Yeh loan upto ₹50,000 tak ke liye hota hai.

- Kishore Loan: ₹50,000 se ₹5 lakh tak ke loan ke liye.

- Tarun Loan: ₹5 lakh se ₹10 lakh tak ke loan ke liye.

Har category ka apna specific purpose aur eligibility criteria hota hai.

Eligibility Criteria:

SBI Mudra Loan lene ke liye kuch basic eligibility criteria hai:

- Applicant Indian citizen hona chahiye.

- Applicant ka business idea viable hona chahiye.

- Age limit: 18-65 years.

- Business ka registration aur necessary licenses available hone chahiye.

Documents Required

Loan application ke liye kuch important documents ki zaroorat hoti hai:

- Identity proof (Aadhar Card, PAN Card)

- Address proof (Electricity Bill, Ration Card)

- Business plan

- Business registration documents

- Bank statements

- Passport size photographs

How to Apply

SBI Mudra Loan apply karne ka process simple hai:

- Visit SBI Branch: Apne nearest SBI branch ko visit karein.

- Fill the Application: Form: Application form ko dhyan se fill karein.

- Submit Documents: Required documents ke sath form submit karein.

- Processing: Bank aapke application ko review karega aur kuch dinon mein aapko update milega.

Interest Rates and Repayment

SBI Mudra Loan ka interest rate market-linked hota hai aur alag-alag loan categories ke liye alag ho sakta hai. Repayment tenure 1 se 5 saal tak ho sakta hai, jo loan amount aur business plan par depend karta hai.

Benefits of SBI Mudra Loan

SBI Mudra Loan ke kuch significant benefits hain:

- No Collateral: Is loan ke liye koi collateral nahi dena padta.

- Flexible Repayment Options: Repayment options flexible hain aur business ke cash flow ke hisaab se decide kiye ja sakte hain.

- Subsidized Interest Rates: Interest rates subsidized hote hain jo chhote businesses ke liye faydemand hai.

Tips for Successful Application

Loan application ko successful banane ke liye kuch tips:

- Clear Business Plan: Apna business plan clear aur well-documented rakhein.

- Proper Documentation: Required documents ko properly arrange karein aur correct information provide karein.

- Good Credit History: Apna credit history clean rakhein, koi default nahi hona chahiye.

Common Mistakes to Avoid

Loan application mein commonly hoti mistakes:

- Incomplete Application: Application form ko adhoora bharna.

- Incorrect Information: Documents mein incorrect information provide karna.

- Lack of Planning: Proper business plan na banana.

Conclusion

SBI Mudra Loan ek bahut hi accha option hai un sabhi logon ke liye jo apna business start karna chahte hain ya expand karna chahte hain. Proper planning aur correct information ke sath agar aap apply karte hain toh aapke successful hone ke chances bahut badh jate hain. Or blogs read krnae kae lea financebabu p jaayea

FAQs- SBI Mudra Loan kya h

1. SBI Mudra Loan ka maximum amount kitna hai?

SBI Mudra Loan ka maximum amount ₹10 lakh hai.

2. Kya SBI Mudra Loan ke liye collateral ki zaroorat hoti hai?

Nahi, is loan ke liye koi collateral nahi dena padta.

3. SBI Mudra Loan ka interest rate kitna hota hai?

Interest rate market-linked hota hai aur alag-alag loan categories ke liye alag ho sakta hai.

4. Loan approval mein kitna time lagta hai?

Generally, loan approval mein 7-10 din lagte hain, lekin yeh case-to-case vary kar sakta hai.

5. Kya mein online apply kar sakta hoon?

Haan, aap SBI ke official website par bhi Mudra Loan ke liye apply kar sakte hain.